2024.04.18

Mitsubishi UFJ NICOS has introduced AI to detect fraudulent use of its credit cards ~”Human know-how/insights x AI” !

According to the Japan Consumer Credit Association, the amount of credit card losses caused

by fraud is steadily increasing, exceeding 25 billion yen in 2020, 33 billion yen in 2021,

and 43 billion yen in 2022, and such losses from January to September 2023 amounted to 40.19

billion yen (1.3 times the amount in the same period in the previous year). Among the

losses, "damage caused by fraud at e-commerce sites due to stolen credit card numbers"

accounted for 93.6% of the total, or 37.63 billion yen. Preventing this type of fraud has

been one of the key industry-wide objectives.

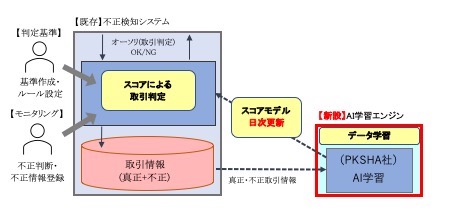

In February 2023, Mitsubishi UFJ NICOS introduced to its fraud detection system an AI

function that gauges and scores inaccuracies detected in authorization transactions

throughout the system to identify fraudulent use of credit cards issued by the company,

including Mitsubishi UFJ Card, MUFG Card, DC Card, and NICOS Card. The system has been fully

operational since April 2023, producing significant results. However, the introduction of AI

was not the only reason for the success of fraud detection: It was the result of Mitsubishi

UFJ NICOS' unique on-site capabilities.

The staff members’ knowledge built over the years contributed to AI learning to improve accuracy.

In the past, card transactions were monitored 24 hours a day, 365 days a year, in shifts by

a fraud monitoring team of several dozen staff per day stationed at the authorization center

(the site where sales approvals from merchants and lost card reports from cardholders are

received). The staff monitored each transaction according to pre-determined transaction

rules. If a fraudulent transaction is detected, the team notifies the cardholder to confirm

the transaction status. The monitoring team at the authorization center collaborates with

the fraud prevention team at the same center to analyze fraud trends and create new rules

for determining fraudulent transactions.

However, fraud methods have grown more diverse and sophisticated. Previously, counterfeit

cards were used chiefly at in-person merchants. Now, they are often abused over the

Internet, and a wide range of products, from game charges to subscription services, are

targeted. The average amount involved in fraudulent use has dropped, making it harder to

distinguish it from genuine use. And when countermeasures are taken, methods of

circumventing them emerge. It was clear that conventional fraud deterrence was reaching its

limits.

PKSHA Security, an AI solution from PKSHA Technology, Inc., was introduced to the existing

fraud detection system to identify fraud that might escape human eyes in both small and

large transactions. In addition, the unique AI algorithm allows it to self-learn the

patterns of ever-changing fraud tactics, enabling it to respond quickly to newly emerged

tactics.

The Mitsubishi UFJ NICOS’ fraud detection system is a great advantage not only because of AI

but also because it takes full advantage of the on-site staff’s knowledge and insights.

Looking at the scores calculated by AI, it is the job of the prevention team to determine

the level at which to suspend suspect transactions. Miho Matsukiyo, a member of the

Authorization Planning Group of the Authorization Management Department, explains:

“Even after introducing AI, we have not changed the general flow from fraud detection to

creating rules for judging transactions. Our fraud detection was already very accurate

before AI, and our rule-setting skills were highly sophisticated. We have AI learn new

suspect transactions as soon as the monitoring team identifies them so that it can update

the scoring model daily to reflect the latest fraud trends.

The prevention team creates

transaction approval rules for various fraud patterns by integrating the scores calculated

by the AI scoring model into on-site human know-how and knowledge to respond quickly and

precisely to prevent damage.

We are producing results rapidly, not only through AI but also through the combined efforts

of our frontline staff.”

Yuta Fukasawa, a member of the Fraud Monitoring Team at Authorization Center 2, who has been

engaged in monitoring work for 20 years, says:

“Fraud monitoring requires experience. Our monitoring team has a number of experts who have

been working to spot fraudulent transactions for many years. We are further improving the

accuracy of fraud detection by having the AI learn their insights.”

Akari Nakamura, a member of the Fraud Prevention Team at Authorization Center 1 that creates

the transaction approval rules, explained the difficulties involved in creating the

rules:

"Before we introduced AI scores, we used to make transaction approval rules by combining

various factors such as the amount of money involved and the number of times a transaction

was made. As AI scores account for unique situations at each merchant and cardholder, using

them enables us to create more efficient and accurate rules. However, since AI scores are

still in the learning stage, rules cannot be created based on AI judgment alone. We are

still in a trial-and-error phase, reviewing the rules to ensure we do not stop legitimate

customer transactions, etc."

The cases and monetary damage of fraud losses have been reduced by more than 30% since the

introduction of AI. The fraud prevention rate and the accuracy of transaction approval rules

are among the highest in the industry, not only due to the introduction of AI but also due

to human know-how, knowledge, ingenuity, and front-line capabilities.

The number and amount of fraud losses reduced by over 30%! The next goal is increased user-friendliness

Going forward, in addition to "fraud damage prevention," the company will aim to ensure a

more comfortable user experience for card holders.

"We are making new discoveries every day," said Fukasawa. "Using AI scores has made it

possible to detect fraud that was previously difficult to uncover. We will continue to make

the best use of AI to achieve a higher level of fraud detection."

“We will continue to make the AI learn more so that we will be able to use AI scores alone

to create more appropriate rules that ensure safe and secure transactions for customers by

detecting fraud while not disturbing genuine transactions,” Nakamura added.

“We have always maintained a very high fraud deterrence level and been able to detect and

stop more than 90% of fraudulent transactions,” says Matsukiyo.

“However, distinguishing

fraudulent transactions from genuine ones is challenging, and inevitably, genuine customer

transactions are stopped occasionally. All staffs at authorization centers are working

together to improve accuracy and block only fraudulent transactions. We also focus on

providing customers with convenient schemes, including a system for informing them promptly

if a transaction has been stopped and a tool to help them resume transactions smoothly via

the website."

INTERVIEWEE

MIHO MATSUKIYO

Authorization Planning Group, Authorization Management Department

YUTA FUKASAWA

Fraud Monitoring Group, Authorization Center 2

AKARI NAKAMURA

Fraud Monitoring Group, Authorization Center 1

Mitsubishi UFJ NICOS Corporation

Akihabara UDX,

4-14-1 Sotokanda, Chiyoda-ku, Tokyo

The company was founded in 1951 as Nippon Shinpan. Mitsubishi UFJ NICOS was established in 2007. As a core company of the Mitsubishi UFJ Financial Group that meets various settlement needs, the company issues credit cards for individuals and businesses, installs settlement systems for member enterprises, and provides card-issuing services on behalf of financial institutions and others. In addition, it has developed a cloud-based system infrastructure to deliver settlement services and rewards management services using smartphone applications associated with co-branded cards. The company offers various settlement services to realize a comfortable, safe, and secure cashless society.