2025.06.19

Mitsubishi UFJ Trust and Banking to launch an outsourcing service for condominium management associations in fiscal 2025—an initiative awarded under MUFG’s Spark X new business incubation program in its first year

In fiscal 2025, Mitsubishi UFJ Trust and Banking Corporation is launching PROTHIRD, an outsourcing service for condominium management associations that received an award under the Spark X program in its first fiscal year. (Spark X is a group-wide new business incubation program run by the Mitsubishi UFJ Financial Group.) So what does the future hold for the new PROTHIRD service?

Mitsubishi UFJ Trust and Banking (the Trust Bank) is launching PROTHIRD, an outsourcing service for condominium management associations (CMAs), in fiscal 2025. The PROTHIRD service won a Spark X award in the first fiscal year of the group-wide new business incubation program, which was commenced in fiscal 2022 by the Mitsubishi UFJ Financial Group (MUFG) with the aim of commercializing ideas proposed by employees.

The Spark X program invites MUFG employees to propose new business ideas focused on resolving social issues and then put their concept into practice. More than 1,000 applicants have come forward with their ideas to date. Each fiscal year, the candidates are whittled down through several rounds of screening, and those selected in the final round are asked to take ownership of their project as the business developer in order to turn their proposed idea into a business. Takahiro Koyama, a member of the Real Estate Business Department of the Trust Bank’s Corporate Business Planning Division, is the originator of PROTHIRD, a new business idea that received the Spark X award in its very first fiscal year.

“When submitting my idea for Spark X, my initial aim was to revitalize neighborhood communities and PTAs that had been facing communication difficulties amid the COVID-19 pandemic,” he explains. “However, it was rather difficult to find monetization opportunities in such communities, so I searched for similar communities and eventually set my sights on CMAs. While being responsible for managing huge amounts of money, CMAs were facing manpower shortages because condominium unit owners, who make up the CMAs, were often reluctant to step up as directors. Being a trust bank, Mitsubishi UFJ Trust and Banking adopts a contract-based business model, so I thought its business was highly compatible with my business idea.”

Mr. Koyama was engaged in corporate pension sales support at the time, but after his initiative was awarded by the Spark X program, he was transferred to MUFG’s Digital Strategy Division in April 2023 to verify the feasibility of his business idea. He subsequently returned to the Trust Bank in June 2024, and now works in his current department with Yuki Yamaguchi, who moved to the department at her own request, and Yu Kitaura, a member of the Pension Customer Services Division, who works with Mr. Koyama on his project once a week in addition to her main job. Mr. Koyama makes sales pitches to real estate developers and condominium management companies to secure outsourcing service contracts from CMAs of new and existing condominiums.

“I joined the Trust Bank as a mid-career hire,” he explains, “but I had no experience in launching new businesses. As a banker, I can perform financial analyses, but I’m not versed in preparing profit-and-loss statements and balance sheets. Thankfully, the Spark X program offers basic training on starting a new business, along with other support programs. I’m still learning every day while working hard to get the new business on track.”

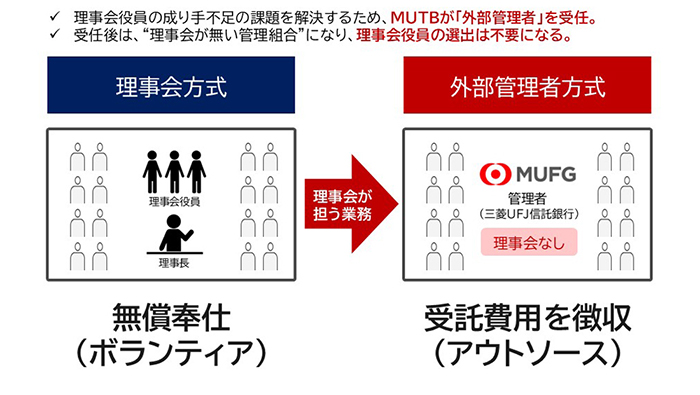

Mitsubishi UFJ Trust and Banking provides an outsourcing service to replace CMA directors.

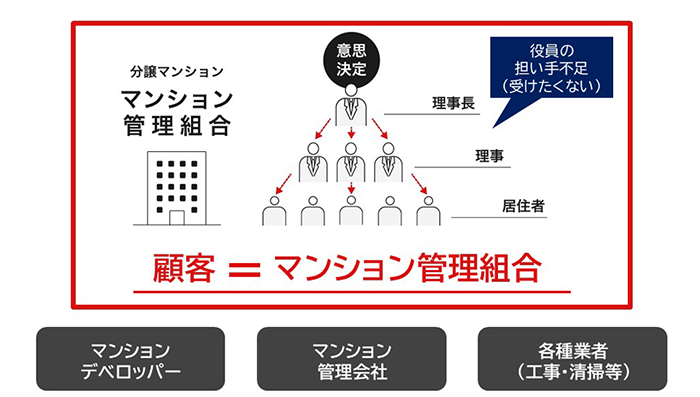

Prospective PROTHIRD customers

Under the Act on Building Unit Ownership, condominiums are required to establish a CMA. Generally, a CMA is operated by a board of directors selected from among the condominium’s unit owners. In practice, however, CMAs face a serious shortage of directors owing to a range of factors. One of them is the changing attributes of new condo purchasers resulting from the surge in condo prices and increasing number of double-income households. The aging of existing condo residents is another factor. CMAs are therefore faced with a need to adapt and evolve with the times.

An increasing number of condominium management companies are signing outsourcing service agreements with CMAs to act on their behalf. This “in-house outsourcing” arrangement allows them to take advantage of their authority to prepare CMA’s general meeting agenda items in order to win construction work orders for themselves, creating a conflict of interest that is becoming an emerging social issue. The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) in June 2024 announced guidelines for CMAs in appointing outsourcing services, asserting that outsourcing service providers need to meet strict requirements to be appointed by CMAs. A legal revision is expected to be made accordingly in April 2026. Outsourcing service providers are responsible for managing large amounts of funds as an agent of the president of the CMA board of directors, and therefore need to be trustworthy and reliable. There are individuals licensed to serve as a condominium manager, but they are rarely employed due to lack of trust. There are also frequent cases of condominium management companies embezzling CMA fees.

Service provided by PROTHIRD

This is where PROTHIRD comes in. The Trust Bank signs a management outsourcing service agreement with a CMA appointing it as its third-party condo manager. Under this arrangement, no CMA board of directors is needed, relieving condo unit owners of the need to select and appoint directors. Revenue is derived from the commission fees received from the CMA.

As Mr. Koyama says, “As a highly transparent, reliable and neutral third-party condo manager, we hope to protect the lifestyle and assets of unit owners and other stakeholders while adding new value to their condo life by drawing on the trust and reliability we have earned as a financial institution.”

PROTHIRD aims to invigorate the condominium industry by promoting awareness to resolve social issues

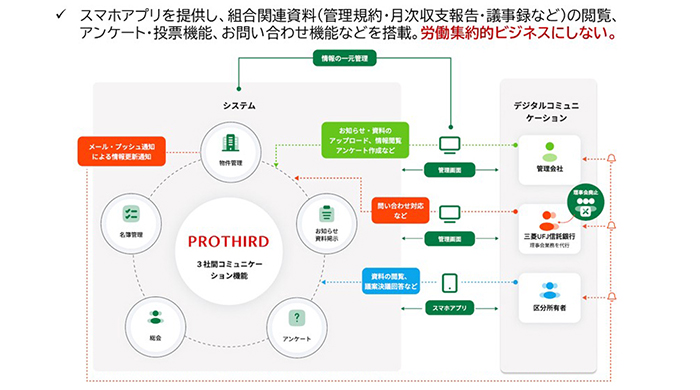

The PROTHIRD service furthermore aims to enhance the value it provides by offering a range of smartphone app functions to promote digital transformation (DX) for CMAs. Specifically, it allows users to view CMA-related materials (e.g., condominium bylaws, monthly financial reports, minutes), conduct surveys/polls and make inquiries, all via smartphone.

PROTHIRD service framework based on DX of information sharing

In addition, the Trust Bank will seek to combine PROTHIRD with MUFG’s financial services and generate new business opportunities in related fields. Examples include extending the lifespan of old condominiums and supporting their refurbishment as well as collaborating with other new businesses springing from ideas recognized by the Spark X program.

The name PROTHIRD was coined by combining “third,” as in “third party,” with the prefix “pro,” which means “on behalf of” and also appears in such words as “professional” and “protect.” In baseball, the third baseman is expected to be strong and agile enough to catch fast balls while also being quick enough and having a powerful enough throwing arm to shoot the ball over to first base.

“So the name expresses the presence and performance of a ‘third party’ that serves as a bridge between unit owners and their condominium management company,” says Mr. Koyama.

To resolve social issues, however, the new business model needs to be promoted on a wide scale. The revision of the law to be drafted by the MLIT, along with other environmental changes, will provide tailwinds, but it remains to be seen how much the “trustworthy and reliable” third-party outsourcing service will gain prevalence as a solution to the shortage of board directors. PROTHIRD is a recurring business model with a low cancellation rate and its tangible demand will contribute to the base revenue of the Trust Bank’s real estate business, but widespread adoption may take some time. Making sales pitches at new condominiums is not that hard, but revenues will not start coming in until after the buildings are transferred to their unit owners. Meanwhile, with existing condos, where general meetings of CMAs are only held once a year, it may take time to reach an agreement.

“And yet we’ve already received informal consent from three clients,” says Mr. Koyama, “which should bring in fee revenues from 2026 at the latest. We aim to secure 10,000 orders within the next five years.”

MUFG’s stated purpose is to be “Committed to Empowering a Brighter Future.” To serve this purpose, Mr. Koyama intends to create new customer experiences through the synergy of lifestyle, finance and digital elements.

Asked for a final comment about their aspirations regarding PROTHIRD, the three interviewees responded as follows.

“Although PROTHIRD is an in-house side job for me, it embodies my aspirations and hopefully will help people and thereby contribute to society.” (Ms. Kitaura)

“Condo board directors have often told me about the difficulty in filling spots. To resolve such issue, I hope to work on our internal system and smoothly get the first contract underway. My goal is to create a system that satisfies unit owners.” (Ms. Yamaguchi)

“In a sense, PROTHIRD constitutes a part of our social infrastructure. Real estate developers and condominium management companies have endorsed our service, and the real estate industry has also embraced it warmly, albeit with some surprise. We welcome competition to a certain extent, as it will energize the industry. We also hope to invigorate the industry by promoting awareness of issues.” (Mr. Koyama)

INTERVIEWEES

TAKAHIRO KOYAMA

Real Estate Business Department

Corporate Business Planning Division

YUKI YAMAGUCHI

Real Estate Business Department

Corporate Business Planning Division

YU KITAURA

Pension Customer Services Division

Mitsubishi UFJ Trust and Banking Corporation

4-5, Marunouchi 1-Chome, Chiyoda-ku, Tokyo

Founded in March 1927. Engages in asset finance business in retail, corporate market, asset management, and market sectors; real estate business; stock transfer agency business; and others. It operates 51 offices in Japan (48 branches and three satellite offices) and five offices overseas (four branches and one representative office). It employs 6,283 people as of March 31, 2024. The percentage of mid-career hires is increasing year by year: 28% in FY2021, 56% in FY2022 and 63% in FY2023.