2025.08.21

Industry’s highest point redemption at 20%! Credit card-linked “Global Point Wallet” for points that are easier to earn and use, greater convenience and benefits

In June 2025, with mobile payment systems widely popularized, Mitsubishi UFJ NICOS Co., Ltd. (“NICOS”) launched the Global Point Wallet app to process contactless payments with Visa and QUICPay+TM at member merchants. The new program allows applicable Mitsubishi UFJ Card membership holders to load Global Points earned by using their credit card into the Wallet for future spending online or offline. In conjunction with this, the new point accumulation program was rolled out, raising the upper limit on the Global Points redemption significantly to 20% from the previous 15%.

Mobile app Global Point Wallet to load points earned and pay for purchases

Before the launch of the new app, users already highly evaluated the Mitsubishi UFJ Card for its generous reward points program, which offers high redemption and preferential benefits. While earning points was appealing, the process of using points had unaddressed issues. The Global Point Wallet was introduced as a solution to deal with those issues. Reo Teramoto, from New Products Planning Group 1 New Products Planning Department , provided information on the background to the app:

“The Mitsubishi UFJ Card reward points program offers a wide range of products and services that can be exchanged for the points accumulated by using the card. In order to increase usage of the card, we thought we should provide new value, and began to examine possible approaches, including the development of a mobile payment app.”

Discussions were held that took into account the preceding release of the MUFG Card App for mobile devices, and the company decided to launch an app exclusive to payment functions, which resulted in the Global Point Wallet. Teramoto outlined the characteristics of the new app as follows:

“Our basic design policy is that the program should be user-friendly and feature simple, intuitive operations. We have also enhanced the MUFG Card App, chiefly by opening a new page for displaying reward redemption data in addition to the existing pages for confirming payment amounts and details for purchases with the card.”

In the Global Point scheme, one (1) basic point is granted for every 1,000 yen spent per month with the Mitsubishi UFJ Card. One basic point is worth five yen, and earned points can be loaded into the Global Point Wallet at this rate. This previously applied only to a limited number of uses, such as exchange for Amazon gift vouchers. Also, the scope of application has been expanded to include the new app. In addition, the Global Point Wallet includes a pre-paid card function linked to NICOS-designated credit cards and debit cards as well as bank accounts at MUFG Bank and other specified banks.

The Global Point Wallet can also be used to make payments with QUICPay+, as well as contactless payments with Visa. Common user perks include a 0.5% redemption of the payment amount to be offered monthly and automatically.

As a security measure, the app provides an immediate notification when each payment session is completed. Teramoto explained, “From surveys using social media, we have found a strong customer need for receiving an immediate notification when a payment is made with a card. So, we incorporated that feature into the app to enhance customer convenience.”

In conjunction with the rollout of the Global Point Wallet, the inaugural campaign is underway to promote the new app. The specific plan is to offer a Global Point Wallet account balance worth 1,000 yen to the first 100,000 people* who download the app and load it with an amount worth at least 2,000 yen using the qualified cards. The campaign is scheduled for the period from June 2 to August 31. Following this, special campaigns will be held as needed, informing app users of details using the membership newsletter and website to encourage usage of the app.

*Please note that the number may have already been reached as of the present.

The Global Point Wallet is also available for those who do not have a Mitsubishi UFJ Card membership, in order to acquire new membership users. Describing this strategic approach, Teramoto said, “Just as we are introducing existing Mitsubishi UFJ Card users to the Global Point Wallet, we are considering introducing non-users to the card by taking advantage of the opportunity provided by the release of the new app. In a sense, the primary target of the app is membership card users, but we also seek to acquire new card users by promoting the app with a strong emphasis on its availability—regardless of whether or not someone has a membership—and its various convenient services.”

New point accumulation program for greater user convenience based on payments for everyday shopping

The new point accumulation program has been designed to provide the industry’s highest point redemption, and went into effect in June 2025. We received a detailed explanation from Yurino Tsuboki, from Point Service Group New Products Planning Department.

“It’s commonly known that high point redemption and convenience in earning points from frequent purchase channels top the list of reasons why consumers register or renew membership for a specific credit card. Against this backdrop, we have begun to notice some recent trends among many credit card companies promoting programs with high redemption but accompanied by a complicated set of eligibility requirements. We recognized the need for the Mitsubishi UFJ Card to enhance the user convenience and benefits of earning points, and started to consider developing appropriate systems.”

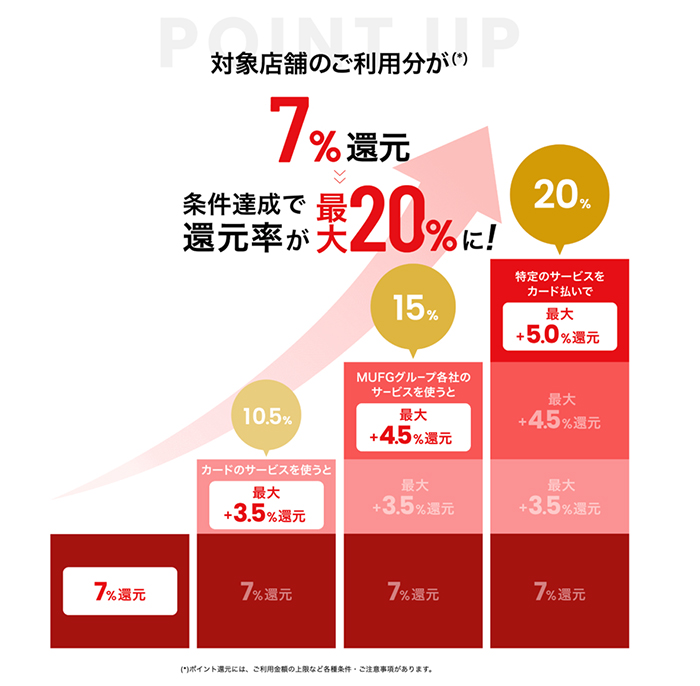

In the new point accumulation program, the maximum redemption rate is set to 20%, out of which 7% is offered to payments at applicable establishments, regardless of whether or not they have registered for the program. The figure has been increased from the previous 5.5%. The applicability of the program, at present, covers a total of 30 brands from convenience stores, supermarkets, restaurants and other sectors, and the company is planning to expand coverage going forward in order to make the program available nationwide.

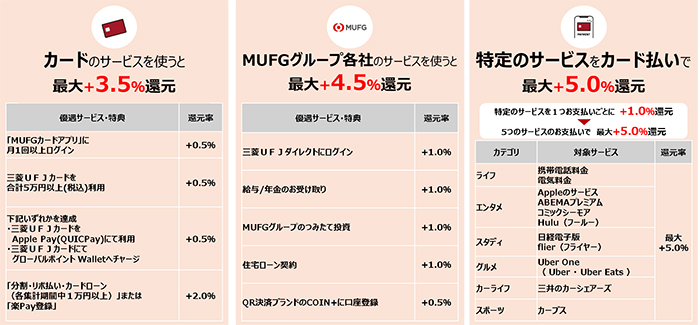

On top of the unconditional offering of 7%, the remaining 13% is provided based on the essential requirement for registration with the program and according to the degree of satisfying eligibility requirements. The eligibility scheme is composed of three areas of services provided: by the Mitsubishi UFJ Card up to 3.5%, including 0.5% for logging in to the MUFG Car App at least once a month, and 0.5% for payment with the card for at least 50,000 yen in total in the month; by MUFG Group companies up to 4.5%, including 1.0% for logging in to the Mitsubishi UFJ Direct account, and 1.0% for setting up an account for receiving salary and pension payouts; and payment for specified services with the qualified card up to 5.0%, with 1.0% for each one of the subscription programs, such as those related to entertainment, as well as mobile phone and electricity billing.

Qualification requirements of the new point accumulation program

Tsuboki summarized the strength of the new point accumulation program as follows:

“The program allows users to pay for long-term subscription services with the card, which is key to the increased point redemption. And redeemed benefits can be effectively used for routine shopping at applicable supermarkets and convenience stores, making it easier to earn points.”

As described above, the Mitsubishi UFJ Card has been revamped through a series of strategies, especially for improving convenience of earning and using points. Furthermore, a limited-time campaign is underway to commemorate the launch of MUFG’s new financial service brand “emutt” in June. It involves gift vouchers worth of a maximum of 50,000 yen for registering a new Mitsubishi UFJ Card membership, opening a new account at MUFG Bank, and meeting other qualification requirements. The campaign is aimed at increasing new memberships significantly by taking advantage of the enhanced strength of the card.

INTERVIEWEES

Reo Teramoto

New Products Planning Group 1

New Products Planning Department

Yurino Tsuboki

Point Service Group

New Products Planning Department

Mitsubishi UFJ NICOS Co., Ltd.

Akihabara UDX, 4-14-1, Sotokanda, Chiyoda-ku, Tokyo

The company assumed its present name in 2007. It is a credit card issuer known for its product lineup, which includes Mitsubishi UFJ Card, MUFG Card, DC Card, and NICOS Card, and it engages in related business activities in various areas. As a core company within the Mitsubishi UFJ Financial Group, it provides a broad range of payment services, such as issuing credit cards for personal and corporate customers, installing payment systems at member merchants’ sites, and undertaking card issuance operations on contract for financial institutions, with the objective of achieving a cashless society that is stress-free, safe, and secure.