2025.09.18

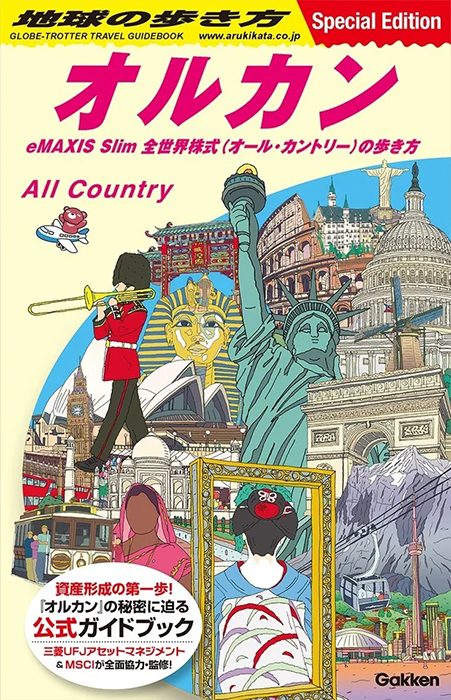

Mitsubishi UFJ Asset Management collaborates with the Globe-Trotter Travel Guidebook!

The first step in building your assets!

Official guidebook to the secrets of Orukan

GLOBE-TROTTER TRAVEL GUIDEBOOK: All Country released in late August

The GLOBE-TROTTER TRAVEL GUIDEBOOK: All Country is a special edition created through a collaboration between the Globe-Trotter Travel Guidebook series and Mitsubishi UFJ Asset Management, that was released in late August. With this book, the company aims to further raise awareness of eMAXIS Slim All Country—an investment fund it manages that is also known as “Orukan.”

Under the supervision of Mitsubishi UFJ Asset Management Co., Ltd., Globe-Trotter Travel Guidebook: All Country, a special collaboration between the renowned Globe-Trotter series and eMAXIS Slim All Country, was released on August 28, 2025. Produced through the full cooperation and supervision of the company and MSCI Inc., this official guidebook delves into the secrets of Orukan. The full-color, 224-page edition is priced at 2,420 yen including tax, and is available at bookstores nationwide and online. Shino Suzuki, Chief Manager of the Product Marketing Group in the Strategic Research Division, commented:

“We hope this publication will not only reach people unfamiliar with Orukan, but also help those already managing assets through it gain a more in-depth understanding.”

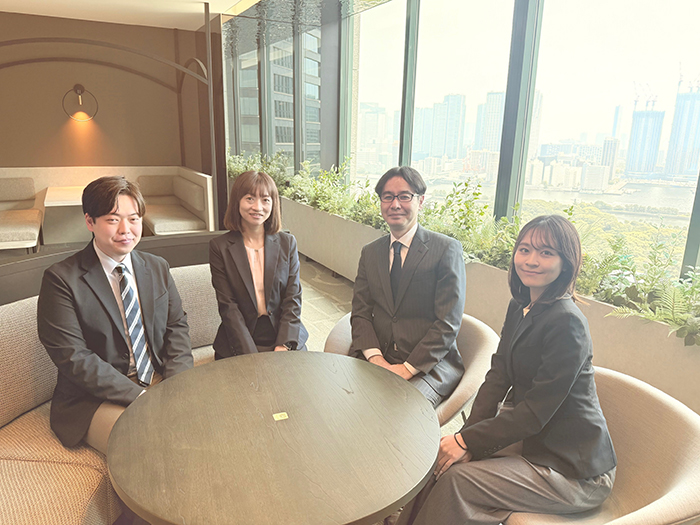

Team discussion

Covering financial and industrial information from 47 countries and regions worldwide

Globe-Trotter is a widely recognized travel guidebook series in Japan. It has also published special collaborative editions on themes beyond tourism, and this guidebook marks the sixth in that line. However, this is the first time that a special edition has explored the world of finance and investment trusts, making the content all the more engaging. True to Orukan’s identity, this guidebook provides financial and industrial insights alongside must-see attractions from the 47 countries and regions included in Orukan’s portfolio. Its roots as a guidebook are also evident in the rich collection of photographs and in-depth coverage of each nation’s industries and companies, together with their geographical profiles. It is a valuable resource for gaining an overview of the world economy. Takeshi Kondo, Group Manager of the Product Marketing Group and Director of the Strategic Research Division, stated:

“This guidebook is designed to satisfy the intellectual curiosity of those unfamiliar with Orukan. It features highlights such as Ferrari’s headquarters and petroleum-related facilities in Saudi Arabia, accompanied by a wealth of photographs and details rarely available to the public. These elements help readers understand where Orukan invests. As readers can get an overview of global business simply by browsing through it, the book also serves as a useful business resource.”

The book is packed with Orukan-related information, including the story behind Orukan’s creation, behind-the-scenes stories, terminology explanations, and a description of a day in the life of a fund manager. Ibuki Kurino, Assistant Manager of the Product Marketing Group in the Strategic Research Division, stated: “I was involved in the production of the book as a supervisor, and I find its content very rich and informative. I hope this book will help guide readers in learning more about Orukan and serve as a tool to support them in making long-term investments and building future assets.”

In addition to basic information on each country and region, the guidebook presents their primary industries, along with the names and industry sectors of the top companies included in Orukan’s portfolio.

Aiming to expand the sales network of the history making hit, Orukan

Orukan is an index-linked investment trust that invests in global stocks. Since the NISA, a tax exemption program for small investments in Japan, was significantly expanded in January 2024, Orukan has consistently ranked near the top of the NISA purchase rankings, with net assets totaling 6,858.3 billion yen as of the end of July 2025. It has become a historic bestseller in the investment trust field, enjoying strong popularity particularly among individual investors. As of June 2025, the number of Orukan holders stood at 5.16 million, based on aggregate figures reported by five major online brokerages. The eMAXIS Slim series, including Orukan, had total net assets of about 18,012.8 billion yen as of the end of July 2025. Rimika Tanahashi, Associate of the Product Marketing Group in the Strategic Research Department, stated:

“Lately, people in their 20s and 30s have been proactively managing their assets with a focus on the future, and they tend to be very curious about investments. We hope Orukan will be embraced by an even wider range of investors in the years ahead.”

One of Orukan’s major appeals is its low cost. Its annual trust fee of no more than 0.05775%, including tax, is among the lowest in the sector. It also allows for broad diversification across 47 countries and regions, as well as approximately 2,500 companies, all without a fixed investment period.

“Going forward, we aim to expand our distribution channels beyond online brokerages to include regional financial institutions that offer online transactions,” said Mr. Kondo.

In addition to Orukan, the eMAXIS Slim series includes another popular fund, the eMAXIS Slim US Equity (S&P 500), which aims to track the S&P 500. Ms. Suzuki shared her thoughts:

“This growing popularity of Orukan indicates that long-term investment is taking root among Japanese individual investors. We will continue to communicate the importance of investing prudently with a long-term perspective. We hope this guidebook will serve as the first step in helping many people feel more familiar with investment trusts.”

INTERVIEWEES

From left to right:

Ibuki Kurino

Assistant Manager

Product Marketing Group, Strategic Research Division

Shino Suzuki

Chief Manager

Product Marketing Group, Strategic Research Division

Takeshi Kondo

Director

Group Manager of Product Marketing Group

Strategic Research Department

Rimika Tanahashi

Associate

Product Marketing Group, Strategic Research Division

Mitsubishi UFJ Asset Management Co., Ltd.

Tokyo Shiodome Building, 1-9-1 Higashi-Shinbashi, Minato-ku, Tokyo

Founded in August 1985, the company changed its name from Mitsubishi UFJ Kokusai Asset Management to its current name in October 2023. As of the end of March 2025, its assets under management totaled 42.1 trillion yen in investment trusts and 6.1 trillion yen in investment advisory and discretionary investment accounts. The company has 911 employees. Its popular products include eMAXIS Slim All Country, also known as “Orukan,” and eMAXIS Slim US Equity (S&P 500), also known as Slim S&P500, which together have over 10 million holders.