2025.11.20

Mitsubishi UFJ Asset Management Staff Volunteers Launch Social Contribution Activities under the Themes of Environmental Conservation and Financial and Economic Education

Maintenance of Shonan Coast Erosion Control Forest

Since FY 2024, Mitsubishi UFJ Asset Management has been promoting its social contribution activities with a focus on environmental conservation and financial and economic education. What have the participants learned from the experience?

Mitsubishi UFJ Asset Management, a wholly owned subsidiary of Mitsubishi UFJ Financial Group (MUFG), has named its unique social contribution activities EMMIT. The term comes from the Japanese word emi (meaning smile) and the word “commit.” The company fully launched activities in FY 2024.

EMMIT was organized by about ten volunteers who responded to the internal open invitation. It is not formal, but rather like an activity club. Since it is volunteer-based, its purpose attracts employees with a high level of interest in social contribution activities and who are willing to take the initiative. They perform tasks primarily on weekends. While planning meetings are held during business hours, weekday activities require participants to take volunteer leave. Currently, the group is divided into two teams, each focusing on environmental conservation or financial and economic education.

Voluntary participation is essential to bottom-up sustainability initiatives

The company has long promoted sustainability management, linking each employee’s work to sustainability and integrating sustainability initiatives with business management. At the same time, a greater emphasis has been placed on more conscious and independent participation by the employees. In essence, EMMIT was created to build a bottom-up approach to energizing internal sustainability activities by allowing employees to participate in the activities of their own volition. It is rare for employees of an asset management company to take the initiative to engage in social contribution activities.

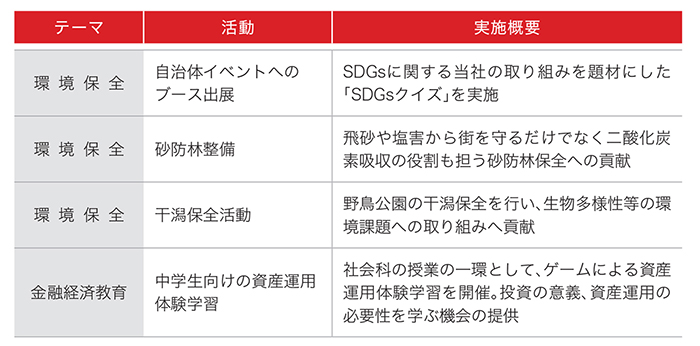

Major Activities for FY 2024

To date, EMMIT’s social contribution activities in the area of environmental conservation include booth participation at the Minato Citizen’s Festival sponsored by Kissport Foundation (Public Interest Incorporated Foundation Minato City Sports, Community, Culture and Health Foundation), participation in the Shonan Coast Erosion Control Forest Maintenance Project sponsored by NPO Green Earth Center, and in the Tokyo Port Wild Bird Park tidal flat conservation project by BLUE BIRD. Shusei Okuda, Fixed Income Investment Group Senior Fund Manager in the Index Investment Division and a member of EMMIT, explains: “Although we gathered as volunteers, we had no experience or knowledge in social contribution activities. So, we started by searching for various reference resources and gathering information. We joined a Minato Ward network of corporate social contribution officers and met them to exchange information. We started our activities with a joint event with them.”

Yukie Osari, Senior Manager of the company’s Sustainable Investment Division, joins the conversation. “EMMIT members come from various sections of the company. Our team was formed in May 2024, and six months later, in October, we were finally able to start our activities at the Minato Citizens’ Festival. Before that, we reached out to NGOs, NPOs, and various organizations through online meetings to see if there was anything we could help with. We had no knowledge and no experience, but were full of enthusiasm (laughs). We started by finding places willing to accept us as we were.”

Engagement in social contribution activities is particularly important

for an asset management company

Turning to the other theme of financial and economic education, the team has conducted hands-on learning programs on asset management at junior high schools in Sanyo-Onoda City, Yamaguchi Prefecture, since February 2025.

“Financial and economic education in schools varies significantly by region, and the same is true for asset management education,” says Mr. Okuda. “Improving financial literacy is absolutely essential in the coming era. However, it’s also a fact that there are certain hurdles for those teaching the subject. Assisting in overcoming those hurdles—that’s where our mission lies.”

With few opportunities for front-line financial professionals to visit regional areas, their classes have been well-received. Children rapidly absorb knowledge, including concepts of risk and return, and react positively to the classes because they are allowed to play app-based games that make learning more enjoyable.

It is especially meaningful for an asset management firm to proactively engage in sustainability activities because, as an investor, it is in a position to scrutinize the operations of corporations, including their sustainability initiatives.

EMMIT laid the groundwork for the company’s bottom-up social contribution activities. This fiscal year, EMMIT began open invitation on a project-by-project basis so that employees who are non-members, but interested in that particular activity, can participate.

“In our daily work, we engage in dialogue with countries and companies worldwide from an asset management perspective,” Ms. Osari explains the meaning of the activities so far. “We discuss sustainability initiatives that contribute to medium- to long-term economic growth and enhanced corporate value, and we encourage them to take appropriate measures. Yet, we ourselves have little chance of visiting the sites of social contribution or environmental conservation activities. EMMIT provides us with opportunities to closely experience social contribution activities, giving us a clearer understanding of the issues and their importance. Moreover, actually going out to join the activities is enjoyable, enhances our knowledge, and heightens our awareness of environmental conservation.”

Mr. Okuda concluded by saying: “As expressed by the name EMMIT, we aim to contribute to creating a society full of smiles while also making it something our employees can commit to with a sense of fun. It is also a major appeal that EMMIT allows meeting diverse individuals and learning from one another. Information won’t come to you unless you take action. If you’re wondering what you can do, or if there’s anything you can contribute, we encourage you to respond to our open invitation and join us.”

INTERVIEWEES

Shusei Okuda

Senior Fund Manager

Fixed Income Investment Group, Index Investment Division

Yukie Osari

Senior Manager

Sustainable Investment Division

Mitsubishi UFJ Asset Management, Co., Ltd.

Tokyo Shiodome Building

1-9-1 Higashi-Shinbashi, Minato-ku, Tokyo

Established in August 1985. Changed its name to the current one from Mitsubishi UFJ Kokusai Asset Management in October 2023. Assets under management include investment trusts of 42.1 trillion yen and discretionary investment management and advisory services of 6.1 trillion yen (as of March 31, 2025). Number of officers and employees: 911 (as of July 1, 2025).

Popular products include eMAXIS Slim Global Equities (All Country) (nickname: Orkan) and the S&P 500-linked eMAXIS Slim U.S. Equities (S&P 500) (Slim S&P 500). The combined number of holders for these two funds exceeds 10 million.