2025.12.18

Mitsubishi UFJ Morgan Stanley Securities Launches Digital Asset Platform “ASTOMO” in October

In response to the increasing momentum for asset formation driven by the new NISA system and other factors, Mitsubishi UFJ Morgan Stanley Securities launched the digital asset business. What is the purpose and goal of this business?

Mitsubishi UFJ Morgan Stanley Securities launched the digital asset business, named “ASTOMO,” in October 2025. At present, digital assets are traded and managed based on blockchain technology, and because of its high transparency and security, the market for these assets has been rapidly expanding in the financial field and in corporate activities. This is a major step forward, driven by tax reforms, an emphasis on social returns, and the growing momentum for asset formation due to the new NISA system.

For security tokens (“STs”), which are actual assets digitalized on a blockchain, the company will make use of the “Brokerage as a Service (BaaS)” securities business platform provided by the fintech company Smartplus Ltd. The two companies will jointly manage the digital securities trading service. They will start with the handling of real estate STs to provide issuers such as business companies with a range of fundraising opportunities while also offering new investment opportunities to investors. The MUFG Group, including the company, will pursue the possibilities provided by digital business in the digital asset domain, such as STs for new assets, including assets held by the Group, Stablecoins and tokenized deposits, thereby offering new value and experiences to customers to meet their sophisticated and diversified needs. Mr. Ryo Fukunaga, Head of the Digital Asset Strategy Office in the company's Corporate Planning Division, said the following:

“So far, securities companies have mainly handled stocks, bonds, investment trusts, funds and REITs. By using blockchain technology, we will be able to deal with new assets as well. In addition to existing traditional securities, we can also transform private assets into STs. Going forward, we would like to provide companies with a range of fundraising means, and investors with new investment opportunities.”

Digital securities online sales service

ASTOMO

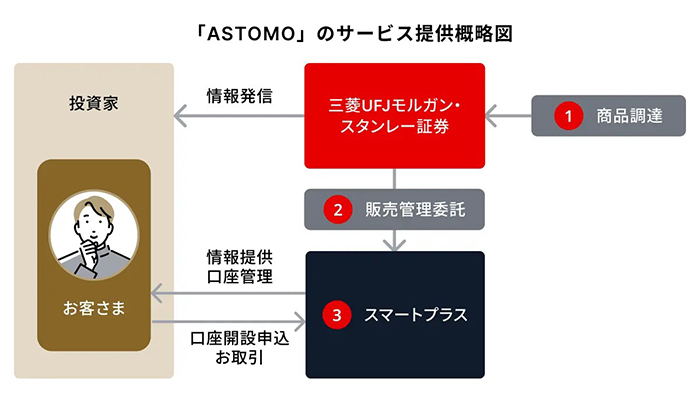

Schematic diagram of the ASTOMO service

The company named the new service “ASTOMO,” meaning in Japanese “to create a better tomorrow together with customers”. Accordingly, the company will add strictly selected digital securities to its customers’ portfolios for the formation of new assets.

The actual flow of the ASTOMO service will be as follows. First, from a professional perspective, the company carefully selects digital securities that can be expected to contribute to customers’ asset formation through the payment of mid-term dividends and redemption at maturity. Then, the company will entrust the sales and management of the selected securities to Smartplus, and customers will use their smartphones to apply for account opening, manage their accounts, and conduct actual transactions with Smartplus. The company will also provide customers with relevant information. Investments in digital securities can be made with as little as 100,000 yen, making it accessible not only to the wealthy but also to individual investors. Fumie Hashimoto, Deputy Head of the Digital Asset Strategy Office in the company's Corporate Planning Division, also stated the following:

“Blockchain technology has made it possible for individuals to make investments in real properties, such as hotels and logistics facilities, more accessible by breaking them down into smaller lots. They can start investing in these properties literally from tomorrow. Amid the trend toward rising inflation, we want a wider range of people to use the service to gain new investment opportunities.”

Smartplus is a fintech company centered on BaaS technology and is a subsidiary of the Finatext Group, which is committed to the realization of embedded finance through the provision of next-generation financial infrastructure. The company aims to conduct financial infrastructure business in the securities field. “Smartplus is a pioneer in the fintech industry, and their system is very lightweight. This platform can be built by a securities company as well. However, as we handle a variety of assets in the future, we want to be able to respond agilely, including in development. With this goal in mind, we decided to collaborate," said Mr. Fukunaga.

Leveraging MUFG’s strengths to

enhance the asset management business in Japan

Features of security tokens (STs)

STs refer to digitalized securities issued and managed on a blockchain. In the Financial Instruments and Exchange Act, STs are defined as “Electronically Recorded Transferable Rights to Be Indicated on Securities, etc.” Real estate STs are securities managed and issued on a blockchain backed by actual, physical real estate properties related to them.

As of August 2025, the cumulative total issuance of STs reached 262.8 billion yen, of which real estate STs accounted for 233.3 billion yen, and from 2025, will continue to increase to 2.5 trillion yen by 2030, showing growth both in terms of issuance amount and the number of issuance cases. In fact, both the public and private sectors are proactively working for establishment and expansion of the ST market, with the entire industry supporting the trend. The progress of private asset-focused STs and the provision of benefits through utility tokens (UTs) will lead to the birth of a new market, making it possible for existing products to be replaced with STs also in the field of traditional securities, such as bonds. This poses a threat to securities companies, but they can also find potential business opportunities in the changing needs of their customers.

The company regards the digital asset business as a strategic priority in its medium-term management plan and aims to build a value chain from structuring through to sales, leveraging MUFG’s strengths. At the same time, the company will work for the establishment of a new business portfolio free of existing products and services, thereby enhancing its asset management functions especially for private customers in and outside Japan, aiming to contribute to enhancement of the asset management business in Japan.

“In the future, blockchain technology will enable us to include even aircraft and ships in the investment target. While providing customers with new products, we would also like to offer new fundraising methods to companies,” said Ms. Hashimoto.

“Blockchain technology will help to increase the number of financial products that can be digitalized. When that time comes, we will meet the needs of customers by making use of MUFG’s comprehensive strengths. We want to fulfill our role in the coming new world,” added Mr. Fukunaga.

INTERVIEWEES

Hajime Kojima

Head of the Digital Asset Strategy Office

Corporate Planning Division

FUMIE HASHIMOTO

Deputy Head of the Digital Asset Strategy Office

Corporate Planning Division

Mitsubishi UFJ Morgan Stanley Securities

Otemachi Financial City Grand Cube, 1-9-2, Otemachi, Chiyoda-ku, Tokyo

The company is the MUFG Group’s core securities general company. It had 5,688 employees as of March 31, 2025. It is a consolidated subsidiary of MUFG, with MUFG holding 60% and Morgan Stanley holding 40%. The company’s strength lies in its ability to meet a range of financial needs in a one-stop way, providing diverse financial products and services in collaboration with MUFG Bank, Mitsubishi UFJ Trust and Banking and other MUFG Group companies. Also, it can make maximum use of Morgan Stanley's network in 42 countries around the world.